Get the free bfi real estate form

Show details

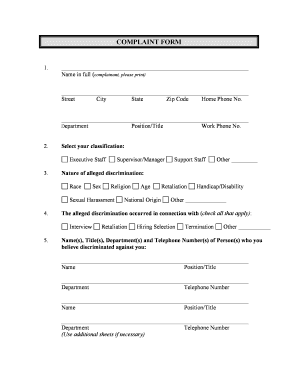

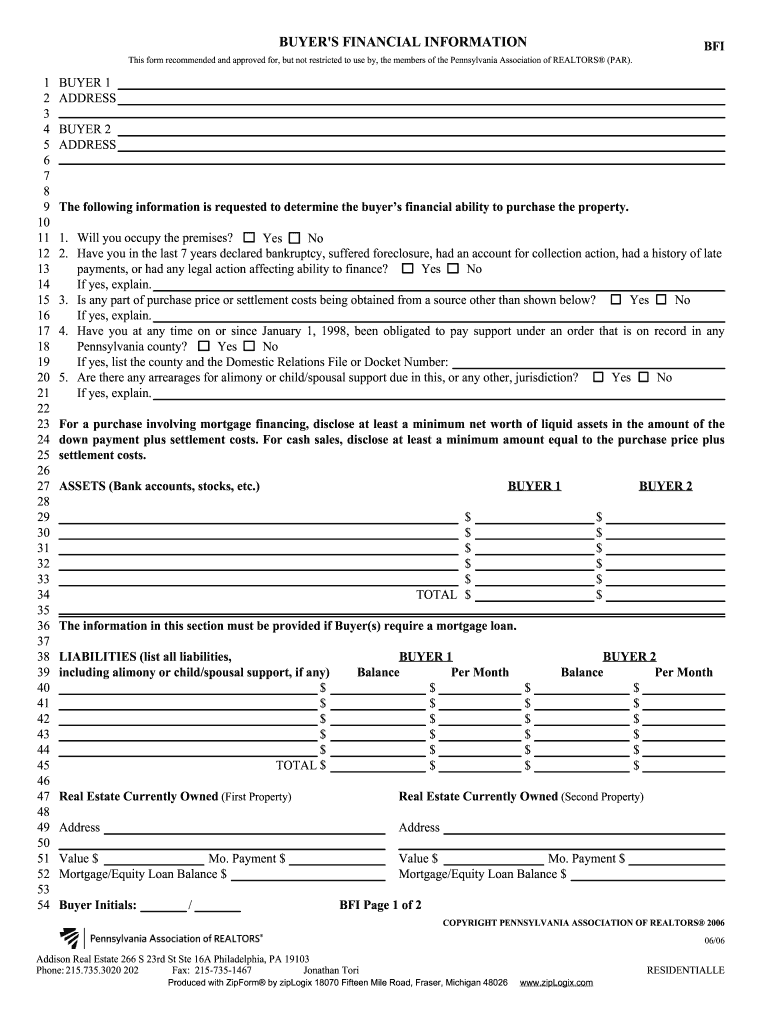

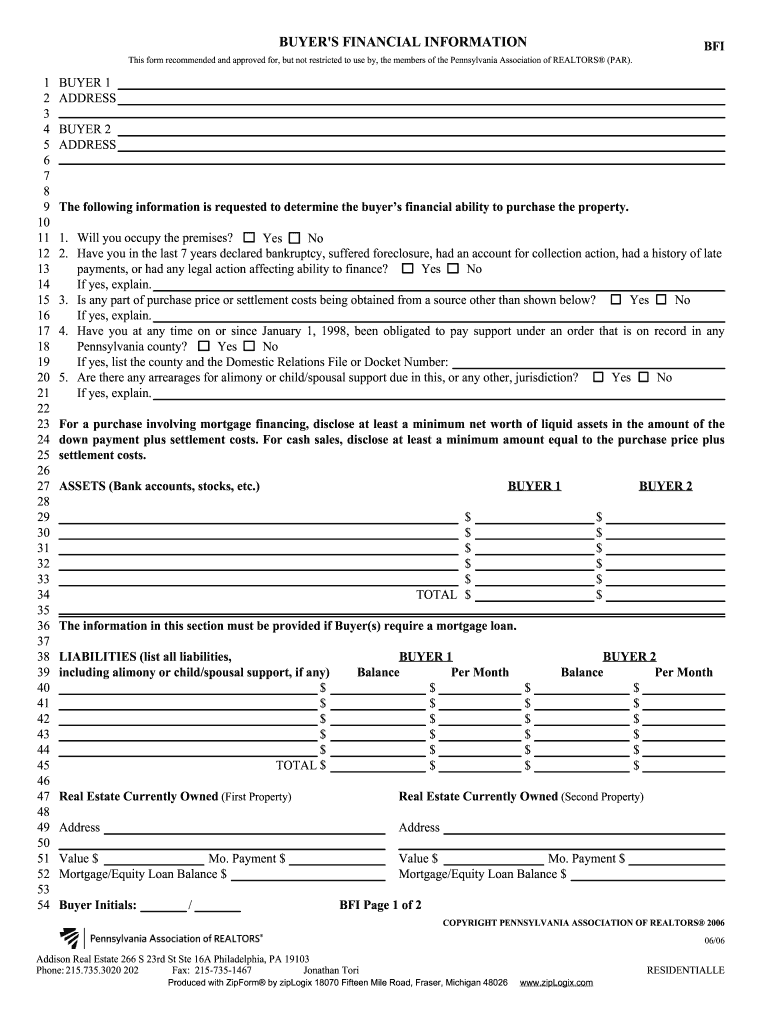

BUYER 1 ADDRESS The following information is requested to determine the buyer s financial ability to purchase the property. BUYER S FINANCIAL INFORMATION BFI This form recommended and approved for but not restricted to use by the members of the Pennsylvania Association of REALTORS PAR. Buyer s further understand that the information may be provided to a lender in conjunction with the placement of a mortgage loan. Buyer s acknowledge that failure to provide truthful and correct information may...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bfi real estate form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bfi real estate form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bfi real estate online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit buyers financial information form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

How to fill out bfi real estate form

How to fill out a gcaar financial information sheet:

01

Gather all necessary financial documents such as bank statements, pay stubs, tax returns, and investment statements.

02

Begin by providing your personal information such as your name, address, contact information, and social security number.

03

Indicate whether you are a buyer or a seller in the real estate transaction.

04

Fill in your income information, including your current employment details, any additional sources of income, and any anticipated changes in income.

05

Provide details about your assets, including your bank accounts, retirement funds, stocks, and other investments.

06

Disclose any liabilities you have, including mortgages, car loans, student loans, credit card debts, or any other outstanding debts.

07

Specify if you have received any financial gifts or loans for the purpose of the real estate transaction.

08

Fill in your monthly expenses, including mortgage or rent payments, utility bills, insurance premiums, and other regular expenses.

09

Complete the section on your credit history, including any bankruptcies, foreclosures, or significant debt delinquencies.

10

Finally, sign and date the form, ensuring that all provided information is accurate and truthful.

Who needs gcaar financial information sheet?

01

Homebuyers who are applying for a mortgage loan.

02

Home sellers who are planning to provide financing options to potential buyers.

03

Real estate agents or brokers who require comprehensive financial information for their clients.

Fill buyers financial information sheet pa : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file gcaar financial information sheet?

The GCAAR Financial Information Sheet is required to be completed and submitted annually by all members of the Greater Capital Area Association of Realtors (GCAAR).

What information must be reported on gcaar financial information sheet?

The GCAAR Financial Information Sheet requires the following information:

1. The total purchase price or contract price;

2. The amount of any earnest money deposit;

3. The amount of any loan commitment;

4. The amount of any other financing;

5. The amount of the buyer's cash down payment, if any;

6. The amount of any seller's subsidy;

7. The amount of any tax credit or other credits;

8. The amount of any closing costs;

9. The length of any loan term;

10. The amount of any mortgage insurance;

11. The type of loan;

12. The interest rate;

13. The date of settlement;

14. The name of the settlement company;

15. The name of the lender; and

16. The name of the title insurance company.

What is gcaar financial information sheet?

GCAAR stands for the Greater Capital Area Association of Realtors, which is a professional real estate trade association representing realtors in the Washington, D.C. metropolitan area. The GCAAR financial information sheet is a document used by GCAAR to collect financial information from its members. This sheet typically includes details such as the member's income, expenses, assets, liabilities, and other financial information to evaluate their financial capability and eligibility for certain membership categories or benefits. It may be used for various purposes, including assessing the member's ability to meet financial obligations and making informed decisions regarding membership status or benefits.

How to fill out gcaar financial information sheet?

To fill out the GCAAR financial information sheet, follow the steps below:

1. Start by visiting the official GCAAR website or accessing the form directly if you have a physical copy.

2. Read the instructions carefully to understand the purpose and requirements of the financial information sheet.

3. Provide your personal information, such as your name, address, contact details, and any other required identification information.

4. Enter information about your current employer, including their name, address, and contact details.

5. Provide details about your employment status, such as whether you are a full-time employee, part-time employee, or self-employed.

6. Disclose your annual income and any additional sources of income you receive. Specify the sources and amounts accurately to the best of your knowledge.

7. If applicable, enter information about your spouse's employment and income. Include their employer's details and income information.

8. Provide details about your assets, including bank accounts, investments, properties, and any other valuable possessions you may have. Specify the estimated values or amounts for each asset.

9. Include information about your liabilities, such as loans, mortgages, credit card debts, and any other financial obligations you have. Specify the outstanding amounts and the lenders' details.

10. If requested, provide additional documentation or proof to support the information you have provided, such as bank statements, tax returns, pay stubs, or any other relevant financial documents. Make sure to submit copies, not originals.

11. Review the completed form carefully to ensure accuracy and correctness. Make any necessary corrections or updates before finalizing it.

12. Sign and date the form to certify that the information provided is accurate and complete to the best of your knowledge.

13. Make copies of the completed form for your records, and submit the original form as instructed by GCAAR. This may involve physically delivering it to their office or submitting it electronically through their designated platform.

Remember to keep a copy of the completed form and any supporting documents for your reference and future use.

What is the purpose of gcaar financial information sheet?

The purpose of the GCAAR (Greater Capital Area Association of Realtors) Financial Information Sheet is to gather and document financial information from individuals interested in buying or selling a property. This sheet helps realtors gather necessary financial details such as employment history, income, assets, debts, and other relevant financial information that can impact a buyer's ability to qualify for a mortgage or negotiate the purchase or sale of a property. This information is essential for realtors to provide accurate advice, assess the financial capacity of buyers, and effectively negotiate on their behalf.

What is the penalty for the late filing of gcaar financial information sheet?

The penalty for the late filing of the GCAAR (Greater Capital Area Association of Realtors) financial information sheet can vary depending on the specific rules and guidelines set by GCAAR. It is recommended to consult the official GCAAR website or directly contact GCAAR for accurate and up-to-date information regarding penalties for late filing.

How do I modify my bfi real estate in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your buyers financial information form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete bfi form online?

pdfFiller has made it easy to fill out and sign buyer financial information sheet. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit buyers information sheet for real estate on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign gcaar financial information sheet. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your bfi real estate form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bfi Form is not the form you're looking for?Search for another form here.

Keywords relevant to financial information sheet

Related to buyer financial information sheet pennsylvania

If you believe that this page should be taken down, please follow our DMCA take down process

here

.